Market Outlook

January 15, 2018

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open positive tracking global indices and SGX Nifty.

BSE Sensex

0.3

89

34,592

US stocks showing a strong move to the upside in last trading session, stocks

Nifty

0.3

30

10,681

remained firmly positive throughout the afternoon. With the upward move, the major

Mid Cap

(0.2)

(31)

18,137

averages once again climbed to new record closing highs. The Dow Jones jumped

Small Cap

0.0

9

19,993

to 0.9% to close at 25,803 and the Nasdaq Composite edged up to 0.7%, to 7,261.

Bankex

0.5

146

29,098

U.K. shares were moving in a narrow range as oil prices dipped and GKN had

rejected a takeover bid from Melrose Industries. The FTSE 100 was up by 0.2% to

Global Indices

Chg (%)

(Pts)

(Close)

close at 7,779.

Dow Jones

0.9

228

25,803

Nasdaq

0.7

49

7,261

On domestic front, Indian shares hit fresh record highs although overall gains

remained modest ahead of Infosys Q3 earnings and readings on consumer inflation

FTSE

0.2

16

7,779

and industrial output due later in the day. The Sensex ended on an upside front of

Nikkei

0.3

66

23,720

0.3% at 34,592 while the Nifty ended at 10,681 with an upside of 0.3%.

Hang Seng

0.8

239

31,651

Shanghai Com

0.1

2

3,431

News Analysis

Result Review: Infosys (CMP: `1,076 / TP: / Upside :)

Advances / Declines

BSE

NSE

TCS Partners with Transamerica to Digitally Transform its Life and Annuities

Advances

1,345

761

Business

Declines

1,592

1,047

IDFC Bank, Capital First set to merge

Unchanged

152

49

Detailed analysis on Pg2

Volumes (` Cr)

Investor’s Ready Reckoner

BSE

5,391

Key Domestic & Global Indicators

NSE

38,117

Stock Watch: Latest investment recommendations on 150+ stocks

Refer Pg5 onwards

Net Inflows (` Cr)

Net

Mtd

Ytd

Top Picks

FII

(523)

1,639

1,639

CMP

Target

Upside

Company

Sector

Rating

*MFs

725

1,457

1,457

(`)

(`)

(%)

Blue Star

Capital Goods Accumulate

789

867

10.0

Dewan Housing Finance

Financials

Buy

613

712

16.1

Top Gainers

Price (`)

Chg (%)

Asian Granito

Other

Accumulate

610

651

6.7

Den

133

20.0

Navkar Corporation

Other

Buy

216

265

22.7

Rtnpower

8

17.1

KEI Industries

Capital Goods Accumulate

406

436

7.3

Gppl

160

9.6

More Top Picks on Pg4

Welcorp

170

7.5

Key Upcoming Events

Tv18Brdcst

66

6.7

Previous

Consensus

Date

Region

Event Description

Reading

Expectations

Jan15

India

Monthly Wholesale Prices YoY%

3.93

4.00

Top Losers

Price (`)

Chg (%)

Jan15

India

Imports YoY%

19.60

Dishtv

78

(6.6)

Jan15

India

Exports YoY%

30.60

Bajajhind

17

(4.6)

Jan15

UK

CPI (YoY)

3.10

Jan16

Euro Zone

Euro-Zone CPI (YoY)

1.40

Rcom

31

(4.3)

More Events on Pg7

Marksans

47

(3.6)

Swanenergy

205

(3.6)

As on January 12, 2018

Market Outlook

January 15, 2018

News Analysis

Result Review: Infosys (CMP: `1,076 / TP: / Upside :)

For 3QFY2018, the company ended up delivering results just in line on the US$

revenue front, while it delivered better than expected on the volume growth front.

The volume growth, which came in at 1.6% QoQ, consequently aided the EBIT

and PAT coming in higher than expected. During 3QFY2018, company posted a

1.0% sequential growth in US$ revenues to US$2,755mn, in line with expectations.

On constant Currency (CC) terms, the company posted a 0.8% qoq. In rupee

terms, revenues came in at `17,794cr a qoq growth of 1.3% qoq. Volume growth

during the quarter was 1.6% qoq. The volume growth at onsite was 0.4% qoq,

while the offshore volume growth during the quarter was 2.2% qoq.

In terms of geography, North America posted a 0.7% CC growth, Europe posted a

4.7% qoq CC growth, India posted a 5.9% qoq CC growth and ROW posted a

4.0% qoq CC growth. In terms of Industry, FSI posted a 0.1% qoq CC growth,

MFG posted a decline of 0.1% qoq CC growth, RCL posted a 1.2% qoq CC

growth and ECS posted a 2.5% qoq CC growth.

On operating front, the EBITDA margins came in at 24.3% V/s 24.2% expected

with an uptick of 10bp qoq, on back of good volume growth and consequently

better employee (excluding trainees) utilization rate of

84.9% V/s 84.7% in

2QFY2018. Attrition (annualized consolidated) during the quarter was 18.7% V/s

21.4% in 2QFY2018. Consequently, PAT came in at `3,697cr, de-growth of 0.8%

qoq. Reported PAT came in at `5,129cr V/s `3,726cr a qoq growth of 37.6%. The

reported PAT came in higher on back of the Tax reversal on back of the APA with

US internal Revenue Service. The reported tax reversal amount has been at

`1,432cr.

In terms of client addition, the company added 7 clients overall. It added, 3 in the

US$75mn+, one in US$50mn and one in US$100mn+. Overall, the client

additions were strong across the board and the active clients during the quarter

was 1191. The Management guidance for the year has remained same at 5.5-

6.5% sales growth of in constant currency (CC) terms, while EBIT margins are

expected to come in at 23-25%. We maintain our neutral stance on the stock.

Y/E

Sales OPM

PAT

EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2017E

70,333

26.0

14,169

61.7

18.9

17.5

3.3

10.5

2.7

FY2018E

75,960

26.0

15,125

65.9

18.7

16.4

3.1

9.5

2.5

Market Outlook

January 15, 2018

TCS Partners with Transamerica to Digitally Transform its Life and

Annuities Business

Tata Consultancy Services (TCS) announced that it has entered into an agreement

with Transamerica, a leading provider of life insurance, retirement and investment

solutions, to enable the transformation of administration of its U.S. insurance &

annuity business lines. The partnership enables Transamerica to rapidly enhance

its digital capabilities, simplify the service of more than 10 million policies into a

single integrated modern platform, and drive greater sustainable growth

opportunities through superior customer experiences. The agreement, a multi-year

partnership with more than US$2bn of revenues to TCS and is expected to be

completed by the second quarter 2018. Thus, the deal will fully reflect in FY2019.

The agreement is expected to lead to annual run-rate savings of approximately

US$70mn initially - growing to US$100mn over time - for Transamerica. We

currently maintain our reduce rating on the stock with a price target of `2442.

IDFC Bank, Capital first set to merge

Finally, IDFC bank got the perfect match that can boost retail presence. The

boards of the IDFC Bank Ltd. and Capital First Ltd. on 13/01/18 approved a

merger between the two entities, creating a lender which will have a portfolio

diversified across large corporate lending, small and medium enterprise loans and

retail credit. Shareholders of Capital First will get 139 shares of IDFC Bank for

every 10 held, IDFC Bank said in a statement after its board meeting on Saturday.

The deal values Capital First at a 12% premium to its closing price on Friday.

IDFC bank loan book has more skewed towards infrastructure sector, which

contributing approx. 48% as on Q2FY18. GNPA stands at 3.9%. Whereas 93% of

the loan book of the Capital first is contributed by retail lending and GNPA stood

at 1.63% as on Q2FY18.

Post-merger, the combined entity of IDFC Bank and Capital First will have

1)

An AUM of Rs 88,000cr

2)

A distribution network comprising 194 branches (as per branch count of

December 2017 of both entities),

3)

353 dedicated banking correspondent outlets and over 9,100 micro ATM

points.

Market Outlook

January 15, 2018

Economic and Political News

India gives $45mn aid to develop Kankesanthurai harbour in Sri Lanka

India needs 533mn tones refining capacity by 2040 to meet domestic

demand

Government amends housing scheme guidelines under PMAY to enhance its

coverage.

Corporate News

Reliance planning own cryptocurrency, Akash Ambani to lead project

MMTC plans a full-fledged portal for transaction of gold and silver

Nissan Motors may make budget e-cars in India, cheapest with Rs 700,000

Domestic pharmaceutical sales growth at eight year low, slips to 5.5%

Quarterly Bloomberg Brokers Consensus Estimate

Federal Bank - Jan 15, 2018

Particulars ( `cr)

3QFY18E

3QFY17

y-o-y (%)

2QFY18

q-o-q (%)

PAT

258

205

25.8

263

(1.9)

Market Outlook

January 15, 2018

Top Picks HHHHH

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its

leade`hip in acute therapeutic segment. Alkem expects

Alkem Laboratories

27,008

2,259

2,441

8.1

to launch more products in USA, which bodes for its

international business.

We expect the company would report strong

Asian Granito

1,835

610

651

6.7

profitability owing to better product mix, higher B2C

sales and amalgamation synergy.

Favorable outlook for the AC industry to augur well for

Cooling products business which is out pacing the

Blue Star

7,563

789

867

10.0

market growth. EMPPAC division's profitability to

improve once operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

19,241

613

712

16.1

presence in tier-II & III cities where the growth

opportunity is immense.

Loan growth is likely to pick up after a sluggish FY17.

Lower credit cost will help in strong bottom-line

Karur Vysya Bank

8,903

123

160

30.6

growth. Increasing share of CASA will help in NIM

improvement.

High order book execution in EPC segment, rising B2C

KEI Industries

3,185

406

436

7.3

sales and higher exports to boost the revenues and

profitability

Expected to benefit from the lower capex requirement

Music Broadcast

2,440

428

475

11.1

and 15 year long radio broadcast licensing.

Massive capacity expansion along with rail advantage

Navkar Corporation

3,252

216

265

22.7

at ICD as well CFS augur well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

3,602

768

813

5.8

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no. 2

viewership ranking in English news genre, exit from the

TV Today Network

2,778

466

500

7.4

radio business, and anticipated growth in ad spends

by corporate to benefit the stock.

After GST, the company is expected to see higher

volumes along with improving product mix. The

Maruti Suzuki

2,85,777

9,460

10,619

12.2

Gujarat plant will also enable higher operating

leverage which will be margin accretive.

We expect loan book to grow at 24.3% over next two

GIC Housing

2,484

461

655

42.0

year; change in borrowing mix will help in NIM

improvement

We expect CPIL to report net Revenue/PAT CAGR of

~17%/16% over FY2017-20E mainly due to healthy

7,878

355

400

12.8

growth in plywood & lamination business, forayed into

Century Plyboards India

MDF & Particle boards on back of strong brand &

distribution network.

We expect sales/PAT to grow at 13.5%/20% over next

LT Foods

3,309

103

128

23.7

two years on the back of strong distribution network &

addition of new products in portfolio.

We expect sales/PAT to grow at 13%/16% over next

two years on the back of strong healthy demand in

Ruchira Papers

469

209

244

16.8

writing & printing paper and Kraft paper. Further,

China had banned making paper from waste pulp

which would benefit Indian paper companies.

We expect financialisation of savings and increasing

Aditya Birla Capital

40,518

184

230

25

penetration in Insurance & Mutual fund would ensure

steady growth.

Source: Company, Angel Research

Market Outlook

January 15, 2018

Key Upcoming Events

Result Calendar

Date

Company

January 15, 2018

Federal Bank

January 17, 2018

Hindustan Unilever, Zee Electronic, Infratel

Source: Bloomberg, Angel Research

Global economic events release calendar

Bloomberg Data

Date

Time

Country

Event Description

Unit

Period

Last Reported

Estimated

Jan 15, 2018

12:00 PMIndia

Monthly Wholesale Prices YoY%

% Change

Dec

3.93

4.00

India

Imports YoY%

% Change

Dec

19.60

India

Exports YoY%

% Change

Dec

30.60

Jan 16, 2018

3:00 PMUK

CPI (YoY)

% Change

Dec

3.10

Jan 17, 2018

3:30 PMEuro Zone Euro-Zone CPI (YoY)

%

Dec F

1.40

7:45 PMUS

Industrial Production

%

Dec

0.20

0.20

Jan 18, 2018

7:00 PMUS

Housing Starts

Thousands

Dec

1,297.00

1,270.00

7:00 PMUS

Building permits

Thousands

Dec

1,303.00

1,288.00

7:30 AMChina

Industrial Production (YoY)

% Change

Dec

6.10

6.10

7:30 AMChina

Real GDP (YoY)

% Change

4Q

6.80

6.70

Jan 23, 2018

8:30 PMEuro Zone Euro-Zone Consumer Confidence

Value

Jan A

0.50

Jan 24, 2018

2:00 PMGermany PMI Services

Value

Jan P

55.80

8:30 PMUS

Existing home sales

Million

Dec

5.81

5.60

2:00 PMGermany PMI Manufacturing

Value

Jan P

63.30

3:00 PMUK

Jobless claims change

% Change

Dec

5.90

Source: Bloomberg, Angel Research

Market Outlook

January 15, 2018

Macro watch

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

5.0

4.5

9.1

4.4

4.1

9.0

8.0

7.9

4.0

3.5

7.6

7.5

3.2

8.0

7.3

7.2

2.9

7.0

3.0

2.4

7.0

6.3

2.2

6.1

6.1

5.7

2.0

6.0

1.2

1.0

5.0

1.0

4.0

-

3.0

(1.0)

(0.3)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

4.9

52.0

5.0

3.9

50.0

4.0

3.7

3.6

3.4

3.3

3.3

3.2

3.0

48.0

3.0

2.4

2.2

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

40.0

5.50

30.0

5.00

20.0

4.50

10.0

4.00

0.0

3.50

(10.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

January 15, 2018

Global watch

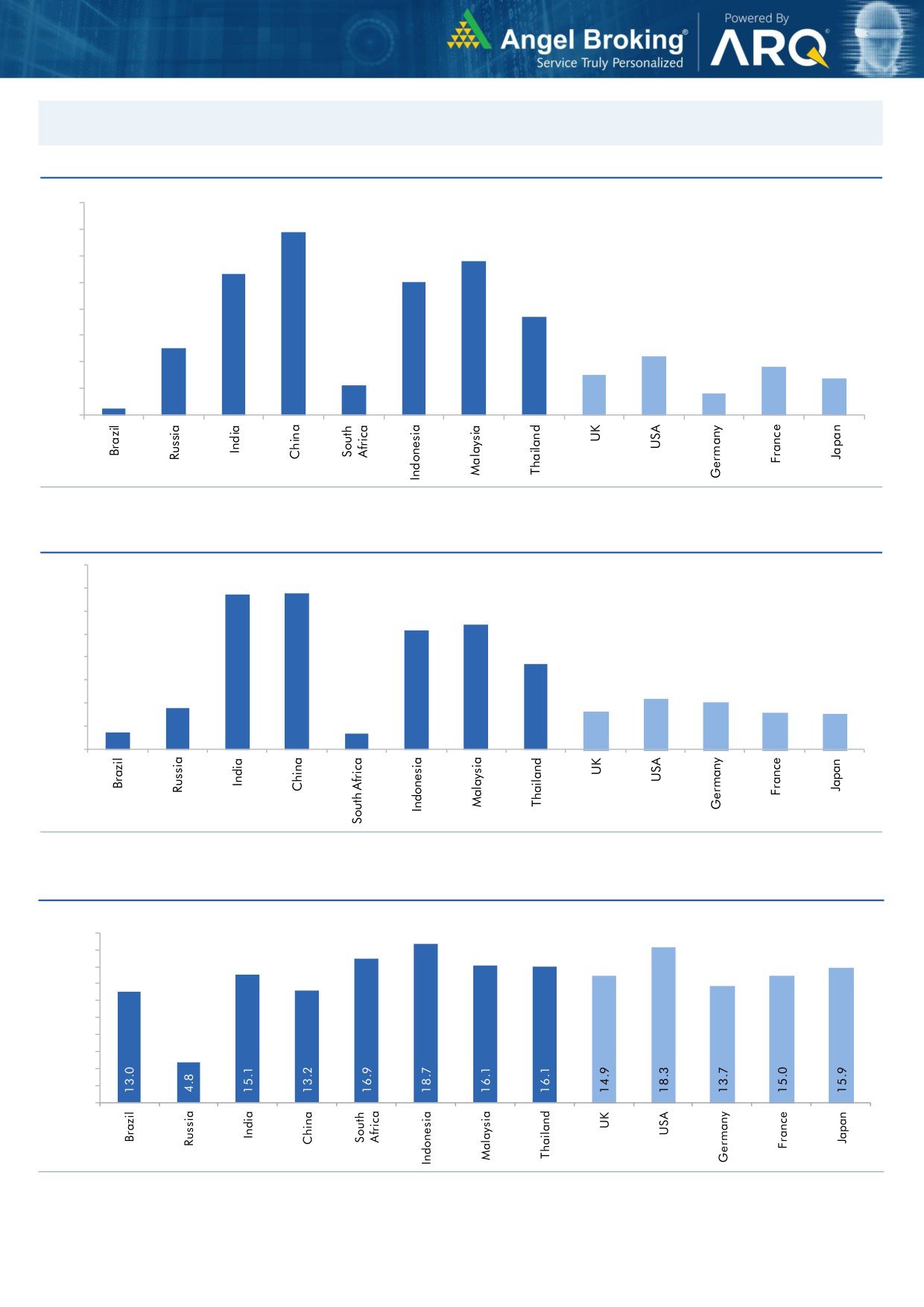

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

January 15, 2018

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

79,349

9.1

3.6

27.8

Russia

Micex

2,262

7.5

8.4

2.3

India

Nifty

10,681

4.3

5.8

28.9

China

Shanghai Composite

3,429

3.9

1.6

8.4

South Africa

Top 40

53,296

3.1

3.6

16.5

Mexico

Mexbol

49,136

3.3

(1.9)

6.7

Indonesia

LQ45

1,083

6.3

10.9

28.1

Malaysia

KLCI

1,823

6.0

3.5

10.6

Thailand

SET 50

1,176

6.8

9.1

19.9

USA

Dow Jones

25,803

5.8

12.8

29.8

UK

FTSE

7,779

5.2

3.2

6.2

Japan

Nikkei

23,654

5.1

14.7

21.2

Germany

DAX

13,245

0.7

2.3

13.9

France

CAC

5,517

2.2

2.9

13.7

Source: Bloomberg, Angel Research p68in4

Market Outlook

January 15, 2018

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India

Limited,Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.